RALEIGH, USA. August 4th, 2023 - In a recent article, MarketWatch Guides uncovered significant disparities in car insurance premiums depending on the location within each state. Broadly, citizens of rural areas pay less, while those in urban and suburban areas pay more.

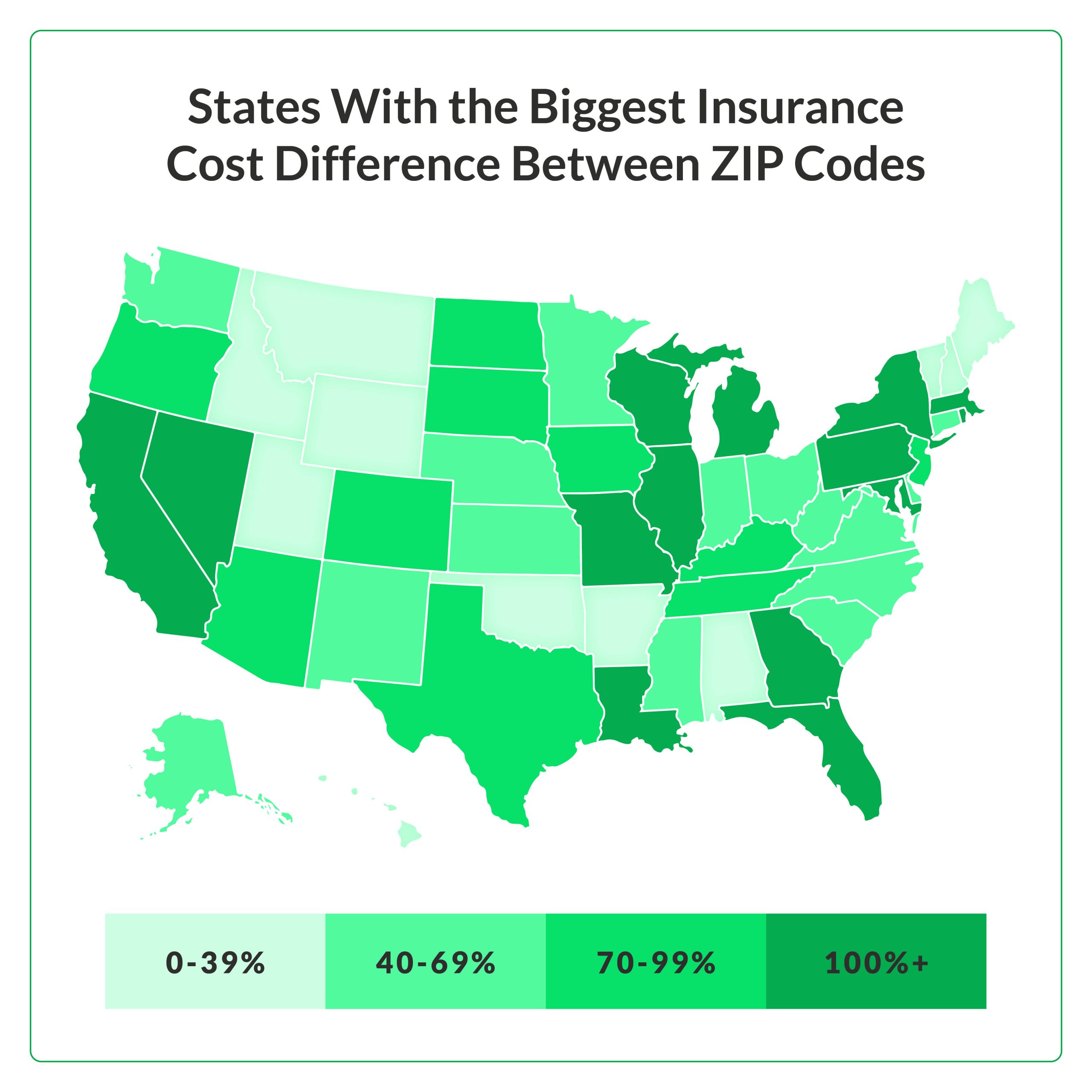

The study found that some states experience much larger discrepancies in premiums based on ZIP codes compared to others. New York tops the list with the largest cost difference between ZIP codes - a whopping 240%. Other states making the top ten include Pennsylvania, Michigan, and Wisconsin.

The disparities can be attributed to a wide range of risk factors, like natural disasters, traffic, and property crime risk. These risks typically increase closer to cities, whereas rural risks are calculated as less hazardous.

Across the United States, the average disparity lies around 75%, meaning that there is a two-thirds increase in auto insurance premiums in ZIP codes closer to the city. This disparity has been cited as a form of modern-day redlining when compared to demographic information nationwide.

The best way to combat heightened insurance premiums in urban and suburban ZIP codes is to find the cheapest car insurance rates. The MarketWatch Guides team recommends comparing quotes from multiple providers. You can also look for discounts, bundle your policies, increase your credit score and opt for less coverage or a higher deductible. Telematics insurance (like pay-per-mile or safe driving programs) is also a good method to get massive savings on auto insurance premiums.